Taxes are due soon. So take a break from the number crunching and read this.

Don’t be like GE and pay ZERO income tax for the year 2010.

Here is a list of 10 companies that paid ZERO taxes in 2010. In fact some of them got a hefty return.

So, everyone complains about how taxes are too damn high…. Right…?

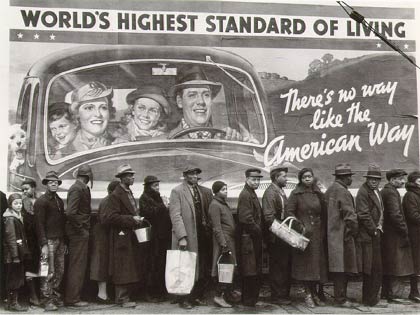

Let’s start this post with a picture:

If we were to eliminate tax breaks for the wealthy, we could have the money to fund the programs that the Republicans in the House want to cut.

Hmmm…. You know taxing the rich does not sound like a bad idea.

Oh…. But you can’t do that. Taxing the rich will cause a transfer of wealth and we can’t have that because it is….

SOCIALISM!!

Really….?

What was it that President Ronald Reagan did in the 1980s by lowering the tax rates for the top earners? Was that not a form of transfer of wealth?

If you look at the last 30 years incomes among Americans, those in the lower income brackets have seen their incomes stagnate if not drop while those in the Top 1% income bracket have seen their incomes exponentially grow.

From the looks of it, I would conclude that the grand experiment of trickle-down economics has resulted in absolute failure. Instead of creating more wealthy people as the people that pushed this idea in the mid-1970s and enacted as the U.S. domestic economic policy of the 1980s, it has resulted in that wealth being concentrated among one group (the Top 1%) while the rest have seen their incomes decline and having to rely more on the social safety net in order to stay afloat.

Even more interesting is that I came to that conclusion and I have no desire to step foot in a college level economics class.

And those that represent the Top 1%, House Republicans, want to do away with the social safety net.

These ideas to remove funding to Planned Parenthood, Medicare, Social Security, public schools, the rights of unions to collectively bargain, and other services is not going to solve our budget problems. Cutting programs actually ADD to the deficit. If you do not believe me, look at what has happened in Texas. Even though we are constitutionally required to have a balanced budget, the last two legislative sessions have resulted in an even greater budget shortfall going into the next legislative session.

Texans, if you think the budget shortfall will be bad for 2011…. I can imagine it is going to get worse when the legislature reconvenes in 2013.

2013…? That’s right, in Texas the legislature meets for 6 months in a two year period to plan and pass laws for a two year period.

Of course, here in Texas our focus is on allowing college students to carry hand guns on campuses, passing an invasive sonogram bill, and advocating for Voter I.D. because, by gum, that will balance the budget.

Yup, Texas, the Land of Fiscal Responsibility… (note: sarcasm)

Apparently, I am not the only one who thinks that taxing the rich is such a radical idea. 61% of Americans in January 2011 support raising taxes on the rich in order to balance the budget.

Republicans in the House think otherwise.

Representative Paul Ryan (R-WI 1), Chairman of the House Budget Committee, has revealed his budget plan for FY2012 called The Path to Prosperity.

More like path to poverty….

Besides draconian measures such as the elimination of Medicare and replace it with a coupon system, Ryan’s plan calls for the LOWERING of the top marginal personal income tax rate from 35% to 25%.

The last time the top marginal personal income tax rate was at 25%?

In 1931

When Herbert Hoover was President

During the Great Depression

The last time the top marginal personal income tax rate was at its highest?

As illustrated by the cartoon and the chart, the top marginal rates for Presidents Reagan and W. Bush combined are not close to their fellow Republicans Richard Nixon and Dwight D. Eisenhower.

So, what does this have to do with taxes and balancing the budget?

Contrary to popular belief, the government does have the right to collect taxes.

The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States;

- U.S. Constitution, Article I, Section 8

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

- U.S. Constitution, XVI Amendment, Ratified 3 February 1913

If you want the defense of the United States and provide for the general welfare, then the government needs some kind of income collection system…. A tax, perhaps…

Based on the charts and the reading that I have done in the time period to compose this piece I have come to this conclusion. The Top 1% has not paid their fair share in order to fund our society over the past 30 years. The result of their lack of contribution to society is a crumbling infrastructure, a public education system that is an embarrassment, and a health care system that is in need of real reform.

And you wonder why companies are not investing in America like they used to….?

What is even more amazing is that they have convinced the general population that the idea of trickle-down economics works when clearly it has not. Then there is the myth, which is still perpetrated to this day, called the “Welfare Queen.”

Their attack has not stopped at the working poor. As we have seen since the start of this year it has now expanded to women, persons of color, workers rights, the LGBT community, immigrants, and yes, even our veterans.

$75 million cut to homeless vets…. $27.4 million given for NASCAR sponsorship!?

Note the insanity there.

I think I have done my best to present my case for why that we need tax reform in this country so that everyone pays their fair share, but for those that don’t agree with me on my politics, I leave you with this question and seriously ask yourself this:

I am not in the Top 1% Tax Margin. In my time as a wage earner, I have not yet benefited from the domestic economic policies of the Republicans. When will I get to experience the effect of trickle-down economics?

No comments:

Post a Comment